India itself is a large market, and the rapid economic growth, as shown in the first quarter, with more money in the hands of people, can trigger the next wave of growth. There is no foreseeable risk for equities, though short-term volatility cannot be ruled out.

The US President Donald Trump called the Indian Prime Minister Narendra Modi four times after announcing a 50 per cent tariff on certain Indian products. Modi did not mind the VVIP’s multiple missed calls; instead, he deliberately avoided engaging with Trump’s habitual loose talk. Trump cannot impose his costly ego on India, nor can any other world leader. Finally, after India refused to bargain and silently rejected all intended conditions, the tariff came into effect on August 27, 2025. That jerked the Indian equities on the following day, later proving that the punitive tariff will no longer determine the course of the Indian market, but other economic fundamentals and corporate earnings. The Indian equity market lost one per cent in value the day before the tariff came into effect, thereby factoring in the tariff impact. With the lower GST and simplification of rate slabs, people have good reasons to spend. Many segments are expected to grow their business volume in the coming months. The Indian market has become more affordable for many products due to the reduction in GST rate and a decline in inflation. This will accelerate the growth.

In almost every sector except FMCG and automobiles, the intra-month losses were heavy. Stocks in sectors like defence, public enterprises, oil and gas, real estate, banking, energy, financial services, metals, and infrastructure experienced significant losses throughout the month. Surprisingly, even pharma lost heavily. The 50 per cent punitive tariff will significantly affect companies focused on textiles, shrimp, gems, and jewellery that heavily rely on the US market. On the other side, the government is contemplating relief measures, while the immediate impact on some companies remains unavoidable. In the long term, a robust home market will develop, capable of absorbing the production of Indian companies, some of which may relocate their production base to lower-cost markets such as Sri Lanka and Vietnam.

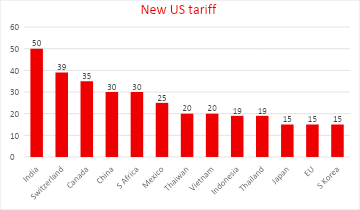

India has four times the population of the US and roughly double that of the entire continent of Europe. India is aware of its strength. Indian exports of goods worth $86 billion last year constituted 2.7 per cent of total US imports, compared with Mexico’s 15.5 per cent, China’s 13.4 per cent, and Canada’s 12.6 per cent. For a short term, the punitive tariff of 50 per cent on labour-intensive items like textiles, marine products, gems, and jewellery may impact half of India’s exports to the US. The India-specific choice of US buyers will either result in them paying more for their preferred option, or the cost-conscious Americans may opt for cheaper alternatives. August was a highly volatile and bearish month, with most stock prices declining sharply. This decline could present an opportunity for small investors. The fear of higher US tariff rates and significant selling by foreign institutional investors (FIIs) hindered the bulls, despite impressive economic growth in the first quarter and well-controlled inflation.

India has buyers for every product made within the country, and its government possesses the wisdom to boost Indian consumption through tax reductions and multiple production incentives. From the prime minister’s speech from the rampart of the Red Fort on Independence Day, one could sense what is in store for Indians.

The US wants India to snap trade relations with Russia and stop buying oil, which some US think tanks, feeding Trump with junk, discovered as Indian funding for the Ukraine war. Europe, the US and even Ukraine are also beneficiaries of India’s Russian oil buying. Therefore, imposing a punitive tariff on select Indian products, which is significantly higher than what the US imposes on other countries like China, the European Union, Mexico, Canada, and Japan, with which Russia also has trade relations, is illogical. The US lost a trusted Asian partner with whom most of the large US corporations love to deal. Many US corporations also depend on the vast Indian market. China and the European Union buy more oil from Russia than India does. Even with the US trade embargo on Russia, the ‘embargoer’ buys chemicals from the latter.

There is another scenario opening for India if the US continues with its country-specific hostile tariff. Punitive action will only drive the US away from potential markets, which China and India, with superior manufacturing and technological capabilities, will surely invade. Trump is too late to understand that the world has changed, India is rapidly shedding the colonial legacy, and the US hegemony is over.

Indian investors, being optimistic about the capability of the government to tackle the issues of trade and commerce, which are temporary, and the economy, are bullish about the growth prospects of India. It is natural that in a vibrant economy, investors always have opportunities. High corporate earnings, quarter after quarter, in sustainable ways, will keep stock prices stable.

Blurb:

Indian investors, being optimistic about the capability of the government to tackle the issues of trade and commerce, which are temporary, and the economy, are bullish about the growth prospects of India.